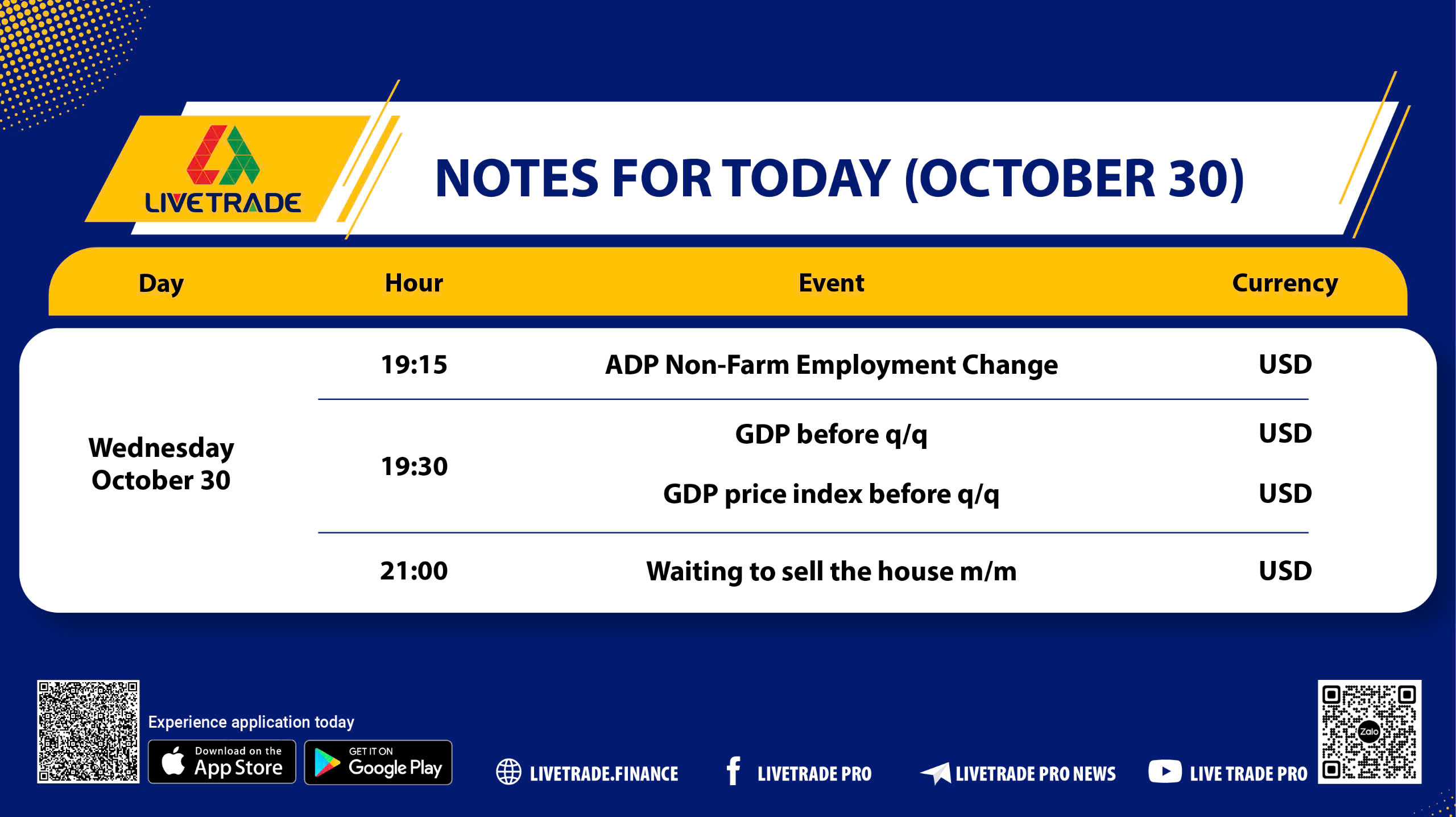

On October 30, the U.S. economic calendar will release crucial indicators related to employment, growth, and inflation, providing a comprehensive view of economic health. These insights are vital for investors and central banks in making strategic decisions amidst market fluctuations.

🔸 ADP Non-Farm Employment Change

This report offers preliminary insights into the job market in the private sector, based on data from over 25 million workers.

- Increase: A rise in jobs indicates economic recovery, leading to increased consumer spending.

- Decrease: A drop could raise concerns about economic health.

🔸 Preliminary GDP q/q

The GDP release is one of the most significant indicators reflecting economic health, measuring quarterly economic growth.

- Increase: Rising GDP can prompt positive policy decisions from the central bank.

- Decrease: A decline may lead to adjustments in economic policies.

🔸 Preliminary GDP Price Index q/q

This index measures inflation, reflecting the value of goods and services in the economy.

- Increase: Rising prices may lead the central bank to adjust monetary policy to control inflation.

- Decrease: Lower inflation could encourage the central bank to maintain current policies.

🔸 New Home Sales Orders

This data predicts the state of the real estate market by tracking signed contracts.

- Increase: A rise in sales orders indicates a healthy real estate market, positively affecting related sectors like construction and banking.

- Decrease: A decline could signal a slowdown in the housing market.

Conclusion

The economic data released on October 30 will provide a clear picture of the U.S. economy, from the labor market to growth and inflation. These indicators may significantly impact investor decisions and monetary policy. Staying informed will help investors make better decisions in a volatile economic environment.

🌐 Fanpage

🗨️ Community Group

📩 Support Email