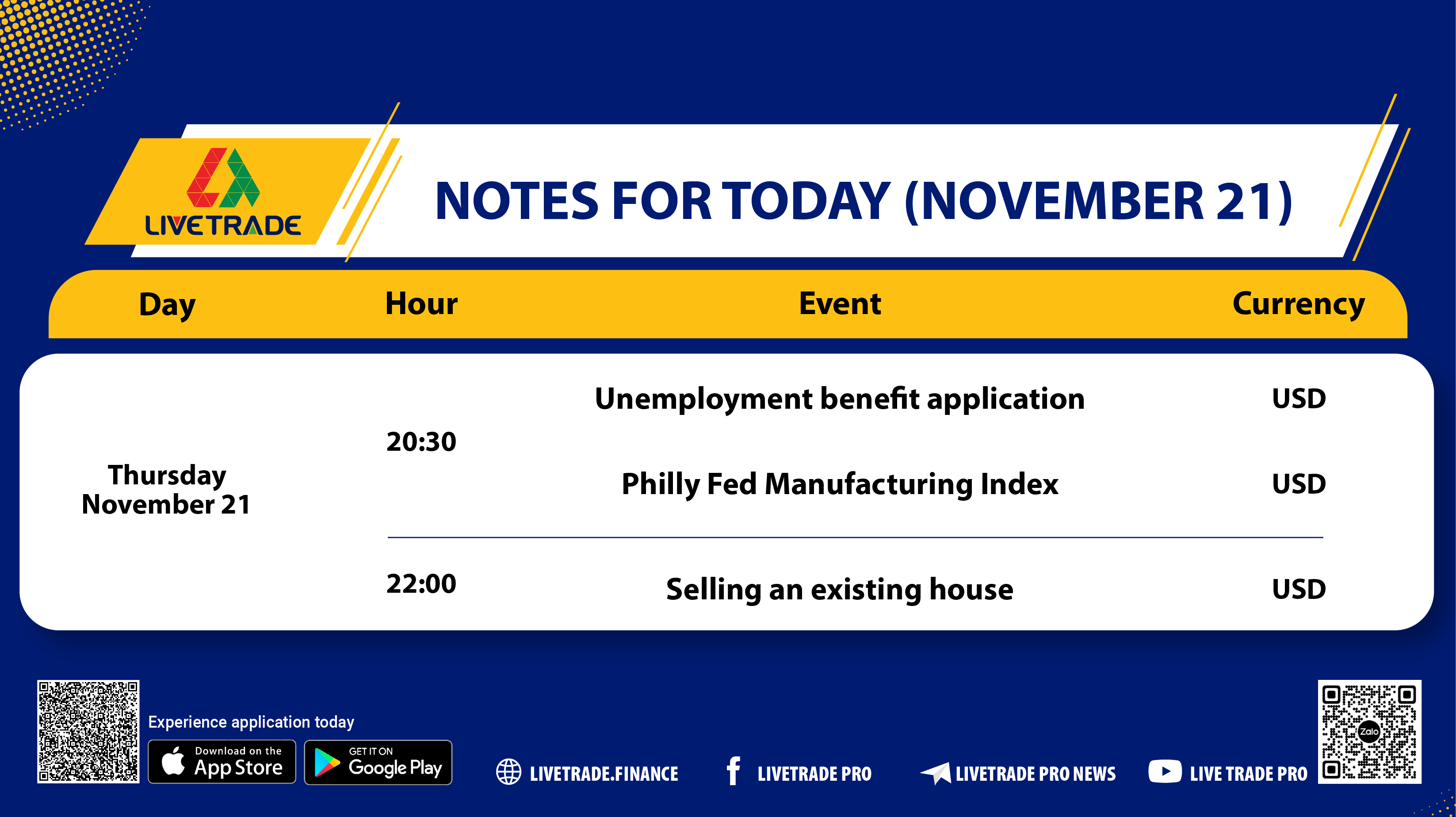

Let’s take a look at today’s important economic information, with key indicators that could significantly impact the financial market and the USD.

Unemployment Claims Data

The data on the number of initial unemployment claims over the past week reflects the state of the labor market. If the figure is lower than expected, it indicates a healthy labor market, supporting the USD’s appreciation. Conversely, higher-than-expected figures will put pressure on the USD, causing it to lose value.

Philly Fed Manufacturing Index

The Philly Fed Manufacturing Index measures the optimism of manufacturers in the Philadelphia region. If this index is higher than expected, it shows good recovery in production, which helps support the USD. Conversely, a lower-than-expected index will put pressure on the USD, potentially weakening its value.

Existing Home Sales

Existing home sales reflect the number of used homes sold during the month (annualized). Higher-than-expected results indicate strong housing demand, supporting the USD’s rise. On the other hand, if the figure is lower than expected, the USD may be negatively affected.

Conclusion

Today’s economic data plays an important role in shaping the trend of the financial market and the USD. Investors need to closely monitor these indicators to seize opportunities and adjust their investment strategies accordingly. Stay updated with LiveTrade Pro to avoid missing any crucial information!