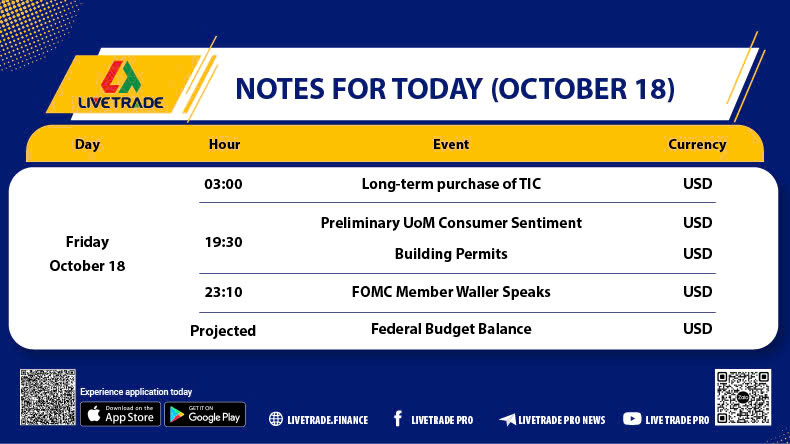

Today, significant economic events will impact the market and the USD. Data on the budget, investments, construction, and remarks from the FOMC will influence economic predictions and monetary policy.

Important Economic News For October 18,2024

🌞 Federal Budget Balance

This indicator measures the difference between the U.S. government’s revenue and expenditure. A positive figure indicates a budget surplus, while a negative one indicates a deficit. This is a crucial factor in assessing the country’s financial health and its impact on the USD.

🌞 TIC Long-term Purchases

This index reflects the balance between domestic and foreign investment, helping to gauge international investors’ interest in U.S. assets. An increase in foreign demand signals positive momentum for the USD, as they need to purchase USD to invest in U.S. stocks and bonds.

🌞 Building Permits

This data provides information on the number of building permits issued during the month, reported on an annualized basis. It is an important indicator of future construction activity, significantly influencing the economy from employment to contractor spending and material supplies.

🌞 Housing Starts

This index shows the number of housing units that began construction during the month, also reported on an annualized basis. While it correlates with building permits, this figure directly reflects the current state of the construction industry—a vital factor in assessing overall economic health.

🌞 FOMC Member Waller’s Remarks

Mr. Waller has been a voting member of the Federal Open Market Committee (FOMC) from 2020 to 2030. His remarks often contain signals about the Fed’s monetary policy, particularly hints regarding interest rates and the economy’s direction. Traders closely monitor this event to predict the Fed’s next moves.

=> Conclusion

Today will bring important data that directly affects the financial markets and the value of the USD. Indicators on the budget, foreign investment, and construction will help investors assess the current economic situation in the U.S., while FOMC member Waller’s remarks will provide further insights into future monetary policy direction.