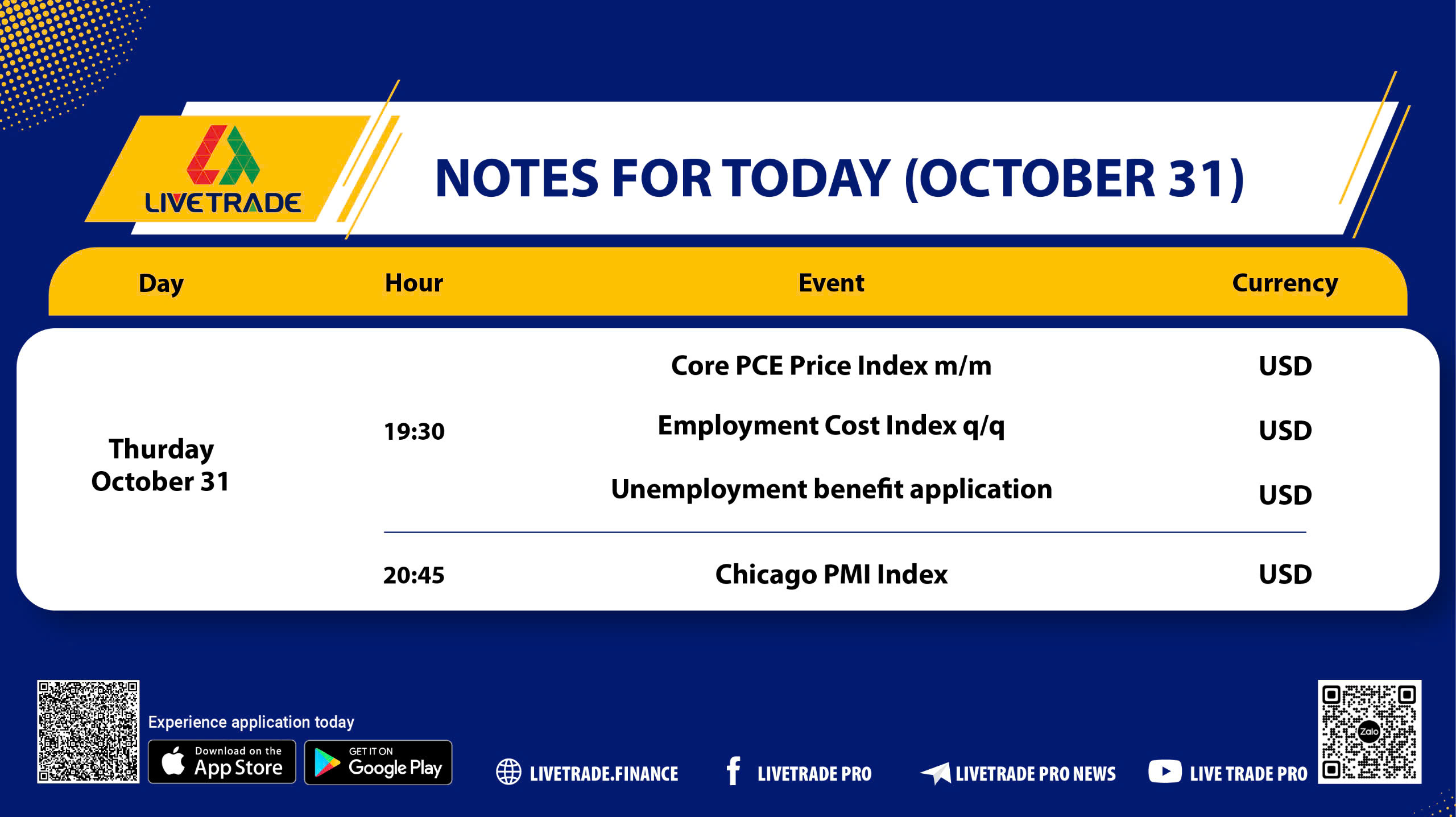

On October 31, several crucial economic indicators will be released, playing a pivotal role in shaping economic policy and investment decisions. Here are the key indicators you shouldn’t miss:

🌻 Core PCE Price Index m/m

This index measures the prices of goods and services consumed by individuals, providing insights into consumer spending behavior. As the primary inflation measure for the Federal Reserve (Fed), core PCE significantly influences monetary policy. If prices rise, the central bank may need to increase interest rates to control inflation.

🌻 Employment Cost Index q/q

This index reflects the cost of labor for businesses. When companies spend more on labor, these costs are often passed on to consumers. It serves as a leading indicator of consumer inflation; rising labor costs may indicate future inflationary pressures.

🌻 Unemployment Claims

This data reflects the number of people filing for unemployment benefits in the week. Although often considered a lagging indicator, unemployment claims are an important signal of overall economic health, closely linked to consumer spending.

🌻 Chicago PMI

The Chicago PMI measures the economic health of Chicago through surveys of purchasing managers. A reading above 50.0 indicates expansion, while below 50.0 signifies contraction. Chicago PMI is a leading indicator of economic health, reflecting current business conditions and future outlook.

=> Conclusion

These economic indicators provide a comprehensive picture of financial conditions and are valuable tools for economic forecasting. Monitoring them enables informed financial and investment decisions, aiming for sustainable growth amid volatility.