As we delve into today’s significant economic events, several key factors will influence U.S. monetary policy and market movements. Investors are urged to stay informed as these developments unfold.

Hot Economic News: FOMC & Richmond Index

1️⃣ FOMC Members’ Speeches: Insights into Interest Rate Policy

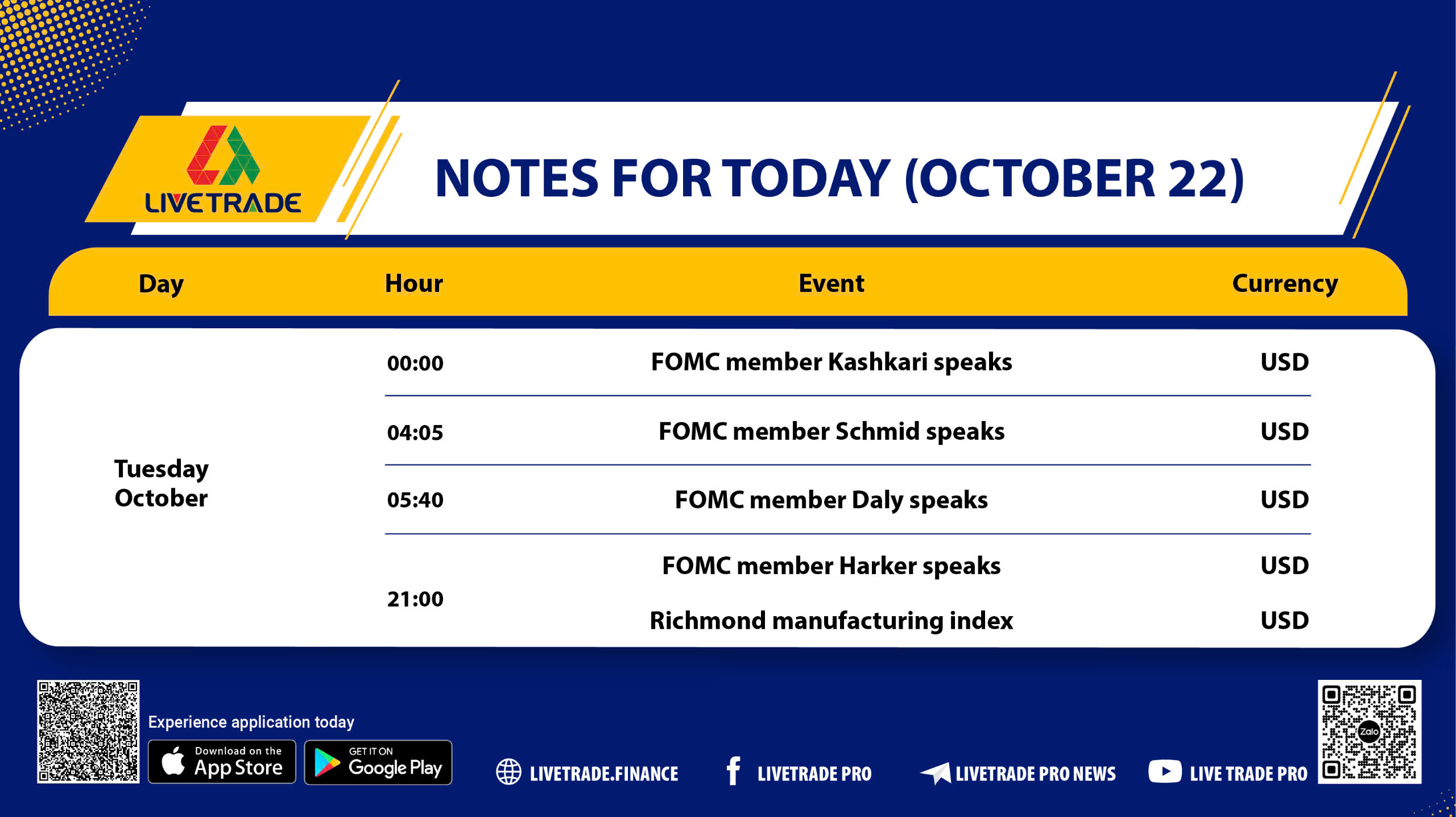

Members of the Federal Open Market Committee (FOMC), including notable figures like Neel Kashkari, Christopher Waller, Mary Daly, and Patrick Harker, will be delivering speeches today. The market is closely watching these statements for signals regarding interest rate adjustments. The FOMC is currently balancing the need to control inflation while supporting economic growth. Any insights provided in these speeches could significantly impact USD fluctuations and shape future policy directions.

2️⃣ Richmond Manufacturing Index: Assessing Economic Health

In addition to the FOMC speeches, the Richmond Manufacturing Index will be released, providing an assessment of business conditions in the region. This index evaluates key metrics, including new orders, shipments, and employment figures. While the impact of this index is often moderate, it offers additional perspectives on the health of the economy and trends within the manufacturing sector.

Conclusion: Monitoring Key Economic Indicators

Today’s economic events are poised to deliver crucial insights into the Fed’s monetary policy and the overall economic landscape in the U.S. Investors should closely monitor the speeches from FOMC members and the results of the Richmond Index to adjust their expectations and refine their investment strategies in response to these developments.