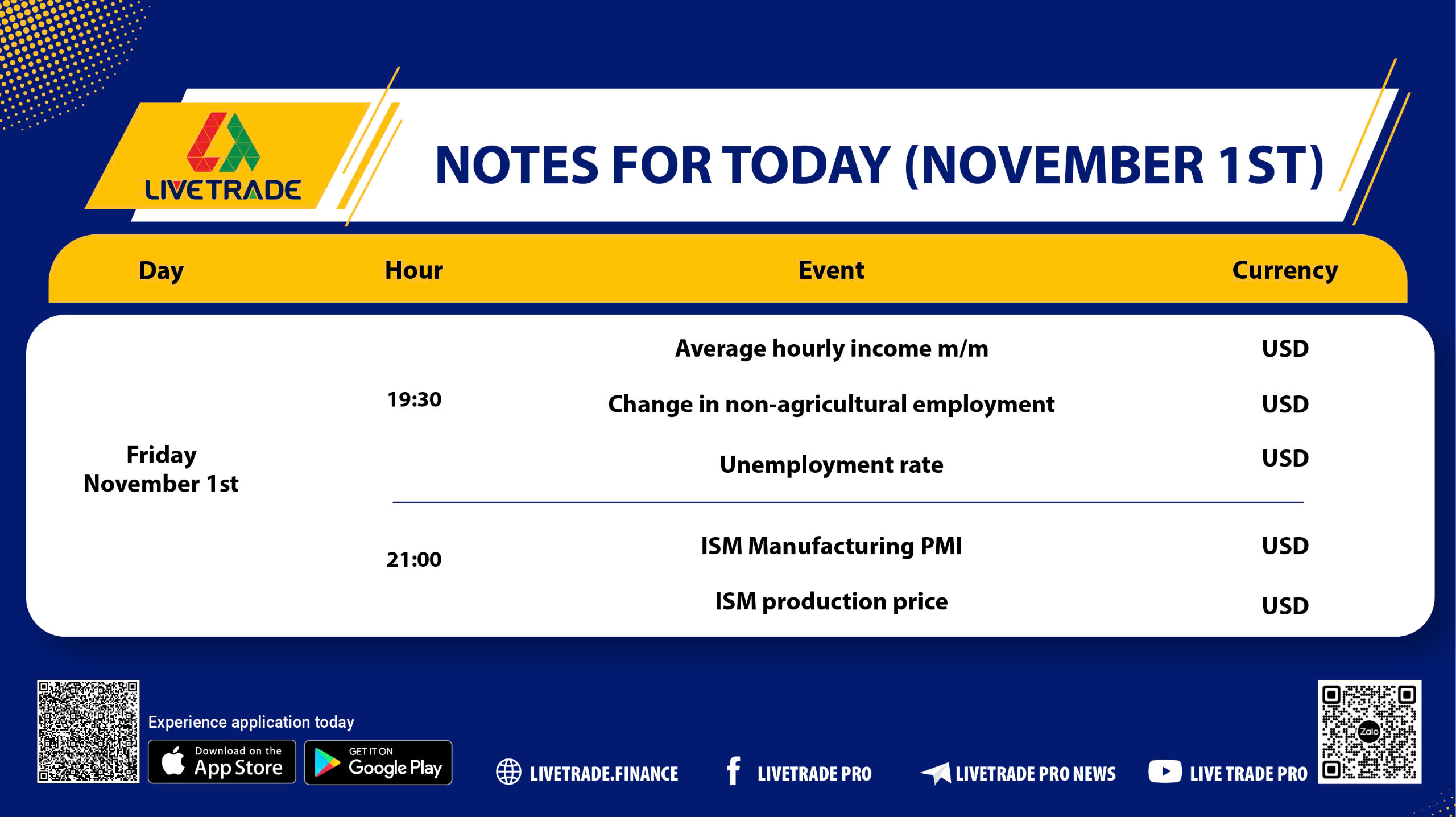

On November 1, 2024, significant economic indicators will be released, offering insights into inflation trends and future economic projections. Tracking these data is crucial for businesses and investors in making strategic decisions.

1. Average Hourly Earnings m/m

A leading indicator of consumer inflation, reflecting labor costs that businesses may pass on to consumers.

- Increase in earnings: Rising labor costs may increase inflationary pressure and lead to tighter monetary policy.

- Decrease in earnings: Lower inflationary pressure may boost spending.

2. Non-Farm Employment Change

This data reflects consumer spending capacity, which is a major component of the economy.

- Increase in employment: Positive economic growth, increased spending, and financial market stimulation.

- Decrease in employment: Weakened spending, signaling potential economic slowdown.

3. Unemployment Rate

Although a lagging indicator, the unemployment rate is a key signal of economic health.

- Decreased rate: Potentially boosts consumer confidence and economic growth.

- Increased rate: May pressure the economy, requiring policy interventions.

4. ISM Manufacturing PMI

The ISM PMI provides insights into production health and business outlook.

- PMI above 50: Economic expansion, boosting investor confidence.

- PMI below 50: Signals recessionary pressures, leading businesses to cut costs.

5. ISM Production Prices

Measuring producer inflation, this serves as an early indicator of consumer inflation pressure.

- Prices above 50: Rising inflationary pressure, likely tightening monetary policy.

- Prices below 50: Reduced inflationary pressure, supporting a potential easing policy.

Conclusion

Today’s indicators serve as essential guides for the economic landscape, helping shape policy planning and informed investment decisions. Staying ahead of these trends fosters strategic insights and supports economic stability and sustainable growth.