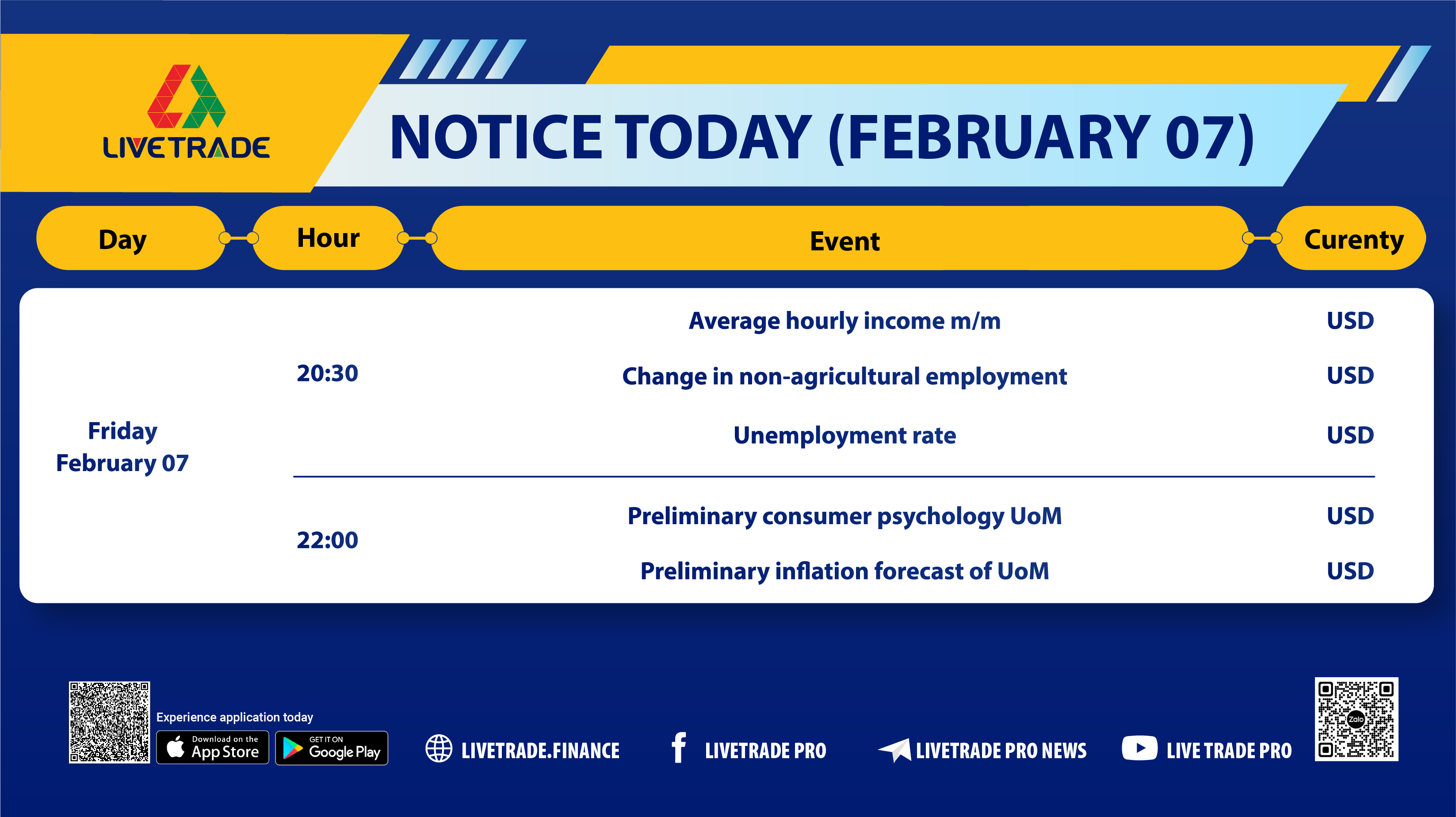

Stay updated on February 7 economic news: Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings, and Inflation Forecast impacting USD and gold. Follow LiveTrade Pro!

📊 February 7 Economic Update: Job Market & Inflation Trends

Today’s financial markets will react strongly to key reports on employment and inflation, directly affecting USD, gold, and monetary policies.

💵 Average Hourly Earnings (m/m)

A crucial indicator of labor cost inflation, reflecting wage pressure on the economy.

- Impact: Higher data supports USD and puts pressure on gold.

📈 Non-Farm Payrolls (NFP)

A vital report on new job creation in the previous month, significantly influencing Fed decisions.

- Impact: Strong NFP strengthens USD, while weak data may boost gold.

📉 Unemployment Rate

A key measure of labor market health, impacting monetary policy expectations.

- Impact: Higher unemployment weakens USD, while lower rates support it.

📊 Preliminary UoM Consumer Sentiment

Measures consumer confidence, reflecting spending trends in the economy.

- Impact: Positive sentiment supports USD, while weak data may push gold higher.

📈 Preliminary UoM Inflation Expectations

An early indicator of future inflation trends, influencing Fed’s interest rate decisions.

- Impact: Higher expectations boost USD, while lower forecasts support gold.

📢 Expert Insight:

With major employment and inflation data releases, financial markets are expected to see increased volatility. Traders should stay alert and adjust their strategies accordingly.

🌟 Stay ahead with LiveTrade Pro and seize investment opportunities!

📩 Website: LiveTrade Pro

🗨️ Join our community: Telegram

📧 Customer support: support@livetrade.io