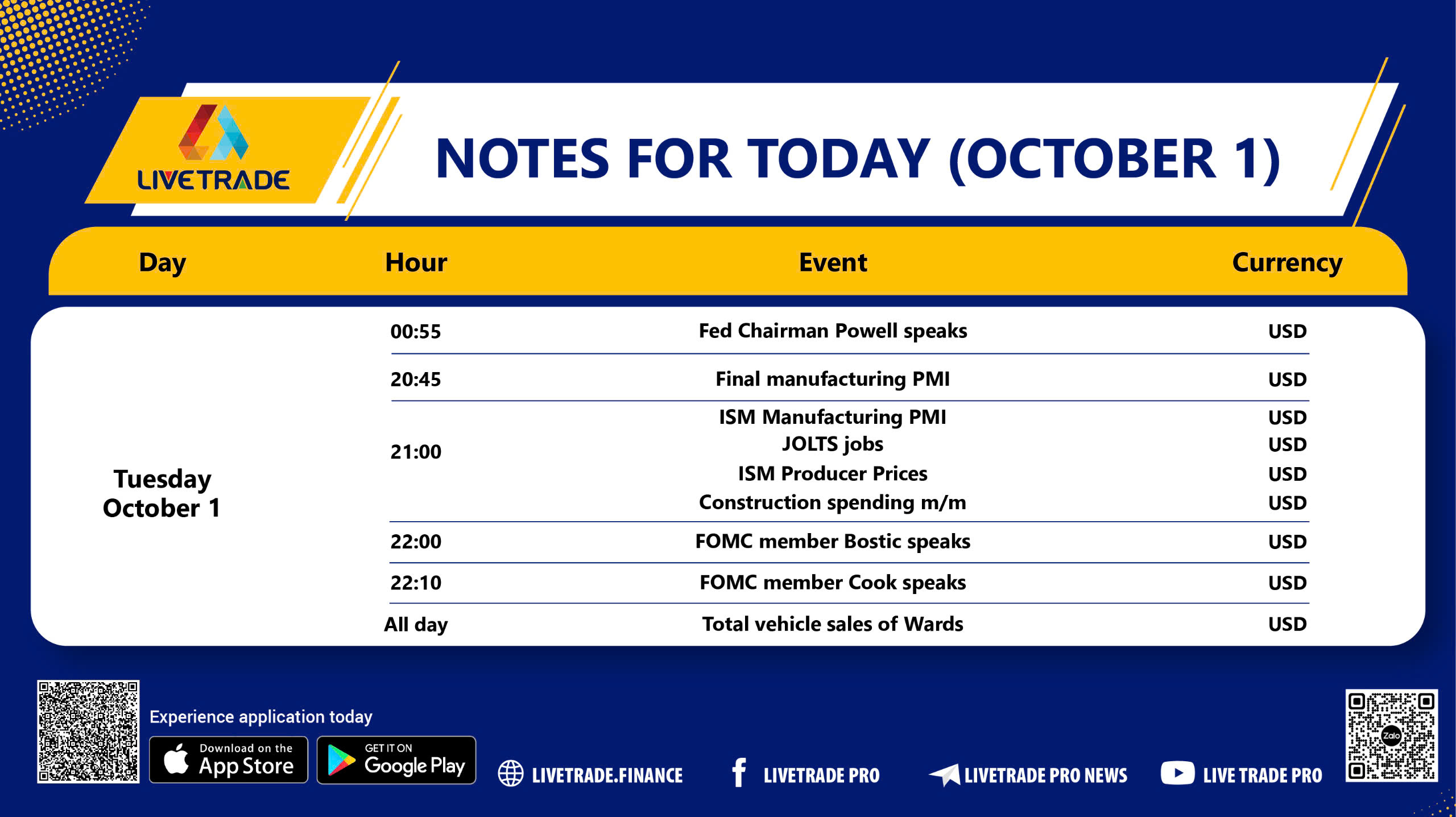

💡 Investors should pay special attention to important economic information today, as indicators and statements from economic leaders will provide insights into the economic situation in the U.S. as well as forecasts regarding monetary policy trends in the near future.

- Fed Chairman Powell confirmed that he will continue to maintain a tightening policy to curb inflation, even though inflation has decreased in July. He also emphasized that the labor market remains imbalanced, and the interest rate decision in September will depend on the latest economic data. After his speech, the USD temporarily weakened but quickly recovered.

- Final Manufacturing PMI: The final manufacturing PMI is forecasted to be around 50.0. A result above 50 will indicate expansion in the manufacturing sector, while below 50 signals contraction, potentially due to weak demand or rising costs. => An important indicator for economic health.

- ISM Manufacturing PMI: The ISM manufacturing PMI will be released, based on a survey of 300 purchasing managers. A result above 50 indicates expansion, while below 50 indicates contraction, helping investors assess the economic situation.

- JOLTS Job Openings: The JOLTS report will provide information on the number of job openings available. This is an important indicator reflecting labor market conditions, impacting consumer spending.

- ISM Producer Prices: The ISM producer prices report will be issued, indicating price trends. A result above 50 indicates rising prices, while below 50 indicates falling prices, which can affect inflation and monetary policy decisions.

- Construction Spending: The monthly construction spending report will show the investment situation in this sector. Growth in construction spending often reflects business and investor confidence in the economic environment.

- Wards Total Vehicle Sales: The vehicle sales report from Wards serves as an indicator of consumer confidence. An increase in sales indicates that consumers are willing to spend on big-ticket items.

- FOMC Member Bostic’s Speech: FOMC member Raphael Bostic will speak. His remarks may influence market sentiment and monetary policy.

- FOMC Member Cook’s Speech: These remarks will be noteworthy as they impact future interest rate predictions.

=> Conclusion

Today promises to have many significant events that could greatly impact financial markets. Investors should closely monitor the indicators and speeches to adjust their investment strategies in a timely manner, optimizing opportunities and responding to potential fluctuations.

Source: Compilation

📲 Update News and Trading Strategies with Livetrade Pro. To receive the most accurate information and trading signals, download the Livetrade Pro app now.

👉 Sign up now to receive offers and start trading effectively at Livetrade Pro: https://invite.livetrade.finance/lYLsEuBa9

📞 Contact for consultation: Fanpage for detailed support.

🔔 News update channel: https://t.me/LivetradeProChannel

💬 Community group: https://t.me/LivetradeproNews

💬 Zalo group: https://zalo.me/g/wjvbwl723

#dailyeconomiccalendar #stockmarket #livetradeapp #livetradepro