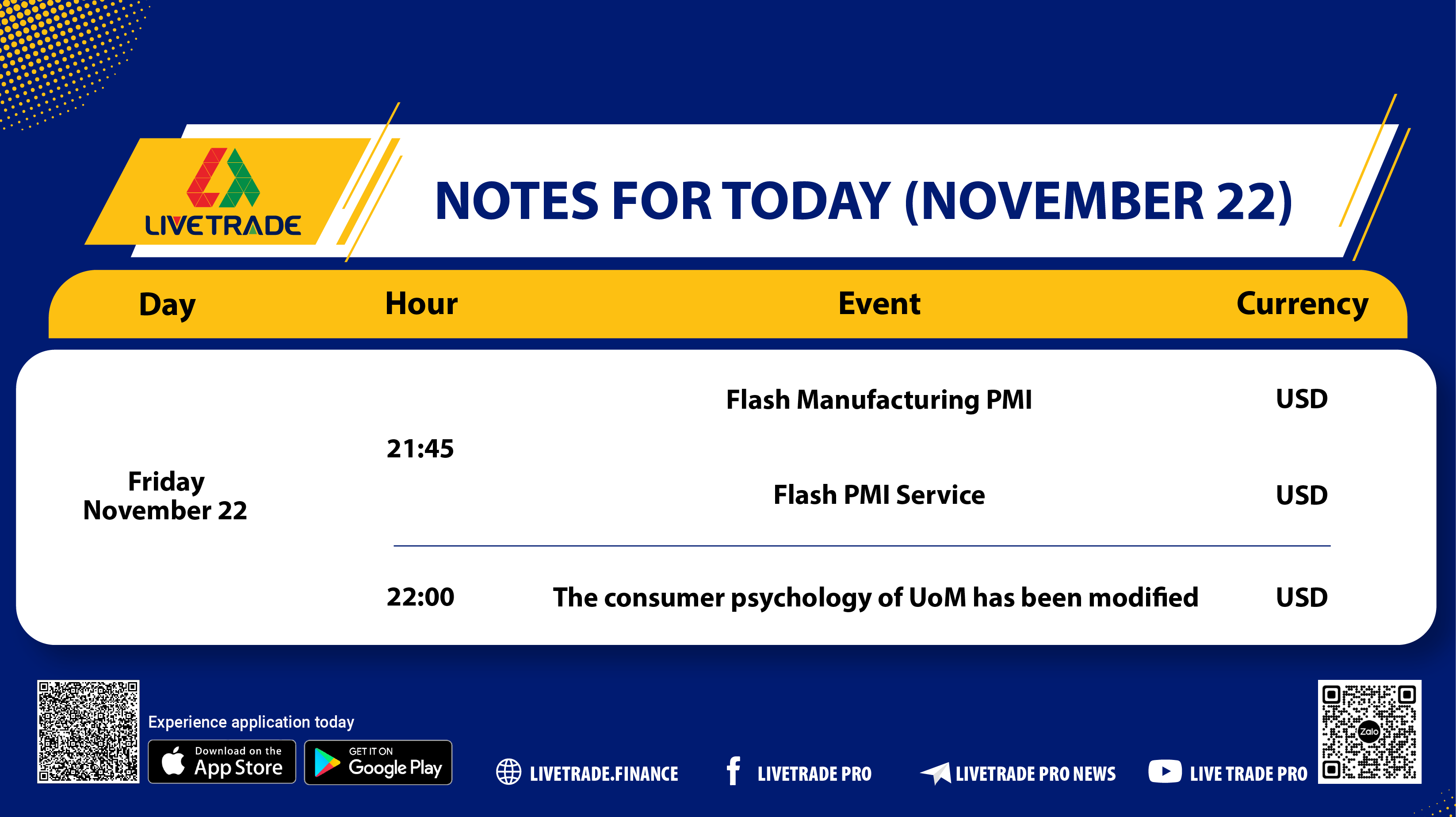

On November 22, important indicators such as Manufacturing PMI, Services PMI, and Consumer Sentiment will be released, providing an overview of the U.S. economy and its potential impact on the USD.

🔥 Flash Manufacturing PMI

The Manufacturing PMI measures production activity, with a threshold of 50.0: above 50.0 indicates growth, while below 50.0 shows contraction. If the data comes in higher than expected, the USD may be supported by expectations of an improving U.S. economy.

🔥 Flash Services PMI

The Services PMI measures activity in the services sector. A reading above 50.0 indicates expansion, while below 50.0 reflects contraction. If the Services PMI exceeds expectations, the USD may strengthen, as the services sector accounts for a significant portion of the U.S. economy.

🔥 UoM Consumer Sentiment

This index reflects consumer optimism about the economy, significantly impacting personal spending. If consumer confidence is higher than expected, the USD may appreciate, as personal spending is a key driver of the U.S. economy.

Conclusion

The data released today will be crucial signals regarding the strength of the U.S. economy and will shape market sentiment. An unexpected result could trigger major volatility, particularly for the USD and related assets.