⭐ Today marks several important economic events that will significantly impact global financial markets. Economic indicators and speeches from FOMC members will play a key role in shaping monetary policy, while consumer confidence and housing price indices will help gauge the health of the U.S. economy.

Important Economic News Today

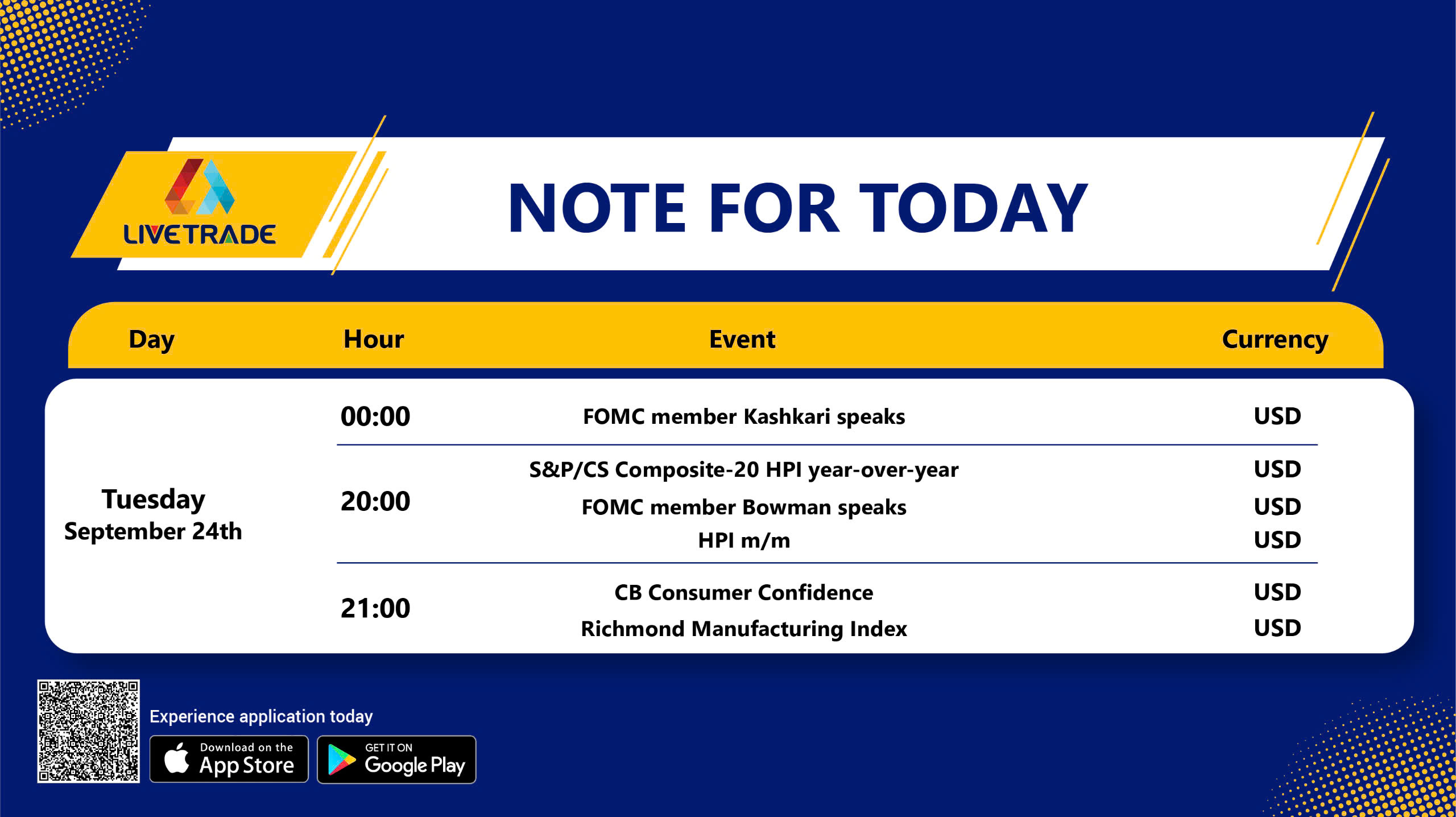

📖 Key Economic Events:

- FOMC members Neel Kashkari and Bowman will deliver crucial speeches. Any hints regarding interest rate adjustments or future monetary policy changes could heavily influence investor sentiment. The market is closely watching whether the Fed will maintain high interest rates or cut them in the near future.

- The S&P/CS Composite-20 HPI Index reveals changes in housing prices across 20 major U.S. cities. An increase signals a healthy real estate market, driven by rising demand or economic improvement. Conversely, a decline may indicate oversupply or economic downturn.

- The FHFA House Price Index (HPI) measures national home price fluctuations. A rise in HPI suggests growing housing demand, while a decrease reflects weaker demand.

Gold Market:

On 23/09, spot gold rose by 0.2% to $2,627.94/oz after hitting a peak of $2,634.16/oz. If employment rates drop significantly, the Fed may lower interest rates, supporting gold prices, while Middle East tensions could further fuel gold’s rise.

Recession Impact:

Yesterday’s PMI data from Europe indicated a decline in both manufacturing and services activity, causing oil prices to drop as demand from major economies weakens. Despite the ECB’s multiple interest rate cuts to stimulate growth, real demand remains stagnant. Should both the Fed and ECB enter a cycle of interest rate cuts, the energy market will face increasing pressure. U.S. crude oil is currently hovering around the $70/barrel support level, closely watched by investors.

Bond Market Movements:

Several long-term U.S. treasury bonds have gained, particularly the 50-year “Guo 2403” and “24 Special Guo 03,” which rose by over 0.7%, indicating that investors are seeking safe-haven assets amid recession risks.

Conclusion: Today’s key events are crucial for traders to monitor. FOMC speeches may determine interest rate trends and impact market sentiment. Changes in the S&P/CS Composite-20 HPI will reflect the health of the real estate market, directly influencing trading decisions. Moreover, pressure from European PMI data could drive oil prices down, providing opportunities for short positions. Keeping a close eye on these indicators will be essential to seize trading opportunities.

Source: Compiled Information

📲 Stay Updated with Livetrade Pro for the Latest News and Trading Strategies.

Download the Livetrade Pro app for accurate trading insights and signals.

👉 Sign up now to receive offers and trade efficiently with Livetrade Pro: Livetrade Pro

📞 Contact for Consultation: Reach out via Fanpage for detailed support.

🔔 News Channel: Livetrade Pro Telegram

💬 Community Group: Livetrade Pro Chat Telegram

💬 Zalo Group: Zalo Livetrade Group